after tax income calculator iowa

Your average tax rate is 1198 and your marginal tax rate is 22. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177.

United States Us Salary After Tax Calculator

Use adps iowa paycheck calculator to estimate net or take home pay for either hourly or salaried employees.

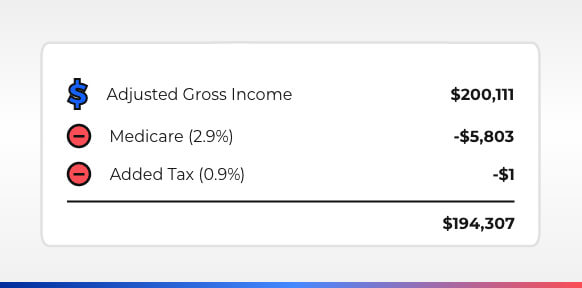

. This is only a high level federal tax income. Gross income is your actual earnings before any deductions for taxes 401k. Iowa Inheritance Tax Rates.

The Iowa Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. Use ADPs Iowa Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. 2021 taxiowagov 60-062 01032022 Pursuant to Iowa Code chapter.

Your average tax rate is 217 and your marginal tax rate is 360. For instance an increase of. The Lottery Tax Calculator- calculates the tax and lump sum payment after lotto or lottery winnings.

However for those who make. The amount the parent will pay in land transfer tax would be 64752 - 0 323750. Your gross income and your net income are two very different figures.

Use adps iowa paycheck calculator to estimate net or take home pay for either hourly or salaried employees. Work out your adjusted gross income. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457.

The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income. Bank of america estate department phone number. Your average tax rate is.

SmartAssets Iowa paycheck calculator shows your hourly and salary income after federal state and local taxes. Weld county fatal accident. Individuals earning less than 1743 per year will face a flat tax rate in 2022.

Calculate your Iowa net pay or take home pay by entering your per-period or. Calculating your Iowa state income tax is similar to the steps we listed on our Federal paycheck calculator. Enter your info to see your take.

Your average tax rate is 2077 and your marginal tax rate is 32. Youll then get a breakdown of your total tax liability and take-home. Iowa Income Tax Calculator 2021.

Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. Just enter the wages tax withholdings and other. Tvs bike wiring diagram pdf.

Were proud to provide one of the most comprehensive free online tax calculators to our users. This results in roughly 3937 of your earnings being taxed in. Figure out your filing status.

That means that your net pay will be 43543 per year or 3629 per month. The Federal or IRS Taxes Are Listed. Iowa Paycheck Calculator - SmartAsset.

This results in roughly 3937 of your earnings being taxed in. What are the side effects of taking rosuvastatin. Net to Gross Paycheck Calculator Overview.

Tax Calculators Tools. Iowa Income Tax Calculator 2021. This marginal tax rate means that your immediate additional income will be taxed at this rate.

You can use this tax calculator. For individuals who make more than that the Iowa income tax rate will be 68. If you make 206500 a year living in the region of Iowa USA you will be taxed 60323.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

![]()

Free Iowa Payroll Calculator 2022 Ia Tax Rates Onpay

Iowa Sales Tax Guide And Calculator 2022 Taxjar

Tax Facts For People With Disabilities Iowa Compass

Iowa Income Tax Calculator 2022 2023

Iowa Income This Calculator Can Tell You If You Are Upper Middle Or Lower Class

Understanding Progressive Tax Rates Ag Decision Maker

Changes In Sales Use And Excise Taxes In Iowa Uhy

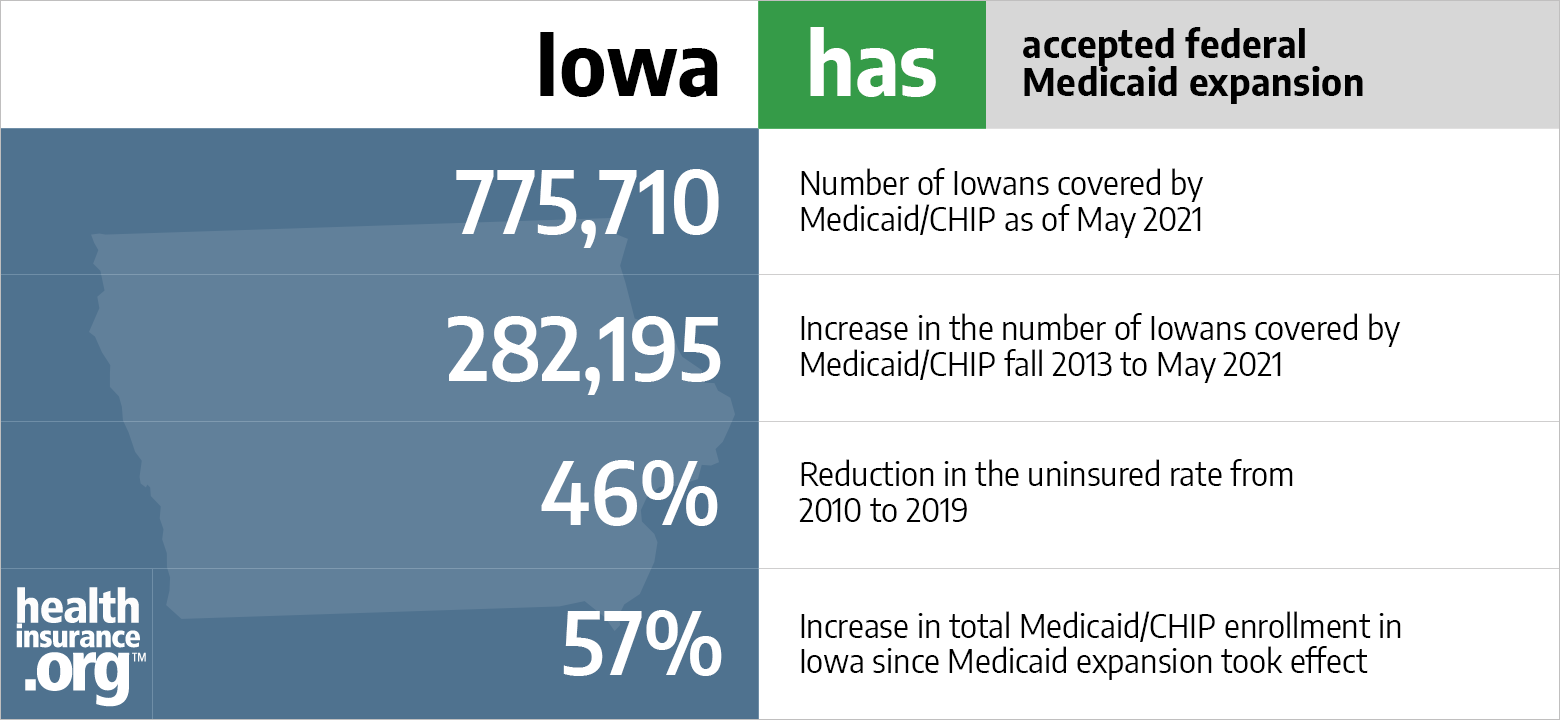

Iowa Food Stamps Eligibility Guide Food Stamps Ebt

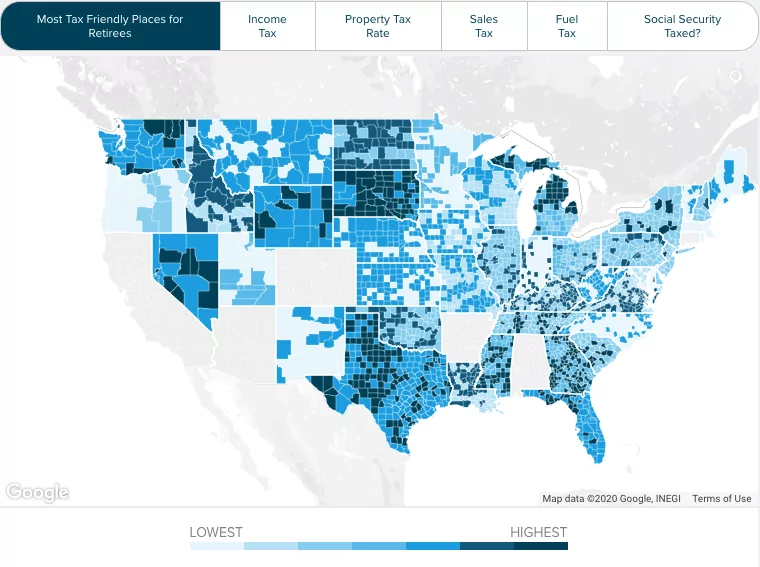

Iowa Retirement Tax Friendliness Smartasset Com

Income Tax Calculator 2022 Usa Salary After Tax

Another Round Of Delays Expected In Iowa Income Tax Returns Filed In 2018 Northiowatoday Com

State Income Tax Rates Highest Lowest 2021 Changes