delayed draw term loan term sheet

3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the. By extending the draw period borrowers enjoy more time.

Understanding The Construction Draw Schedule Propertymetrics

Sample 1 Sample 2 See All 12 Delayed Draw Term Loans.

. In connection with the foregoing the Commitment Parties are pleased to advise you of their commitment to provide the Delayed-Draw Term Loan Facility on a several and not joint basis in the amounts set forth opposite each such Commitment Partys name on Annex 1 hereto the DDTL Commitments upon the terms set forth or referred to in this Commitment Letter. Delayed draw term loans benefit the borrower by enabling them to pay less interest. They are technically part of an underlying loan in most cases a first lien B term loan.

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. 2 Download Print - 100 Free. Us Financing guide 12.

For instance at the origination of the loan the lender and borrower might consent to the terms that the borrower might take out 1 million each quarter out of a loan valued at a total of 10 million. Image of agreement principal debt - 181467720. 137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents.

No more than eight 8 Delayed - Draw Term Loan Borrowings may be made during the Delayed - Draw Term Loan Availability Period. A delayed draw term loan expects that special provisions be added to the borrowing terms of a lending agreement. Hence they avoid paying interest on a lump sum of cash they may not use for many months.

Above as reflected on the consolidated balance sheet of the Borrower and its Restricted. Delayed-draw term loans or DDTLs of up to two years are standard features of financing from private credit providers. More time to request additional funds.

A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of time the borrower can use the undrawn value of the loan. The Delayed Draw Term Loans made by each Delayed Draw Term Lender may at the request of such Delayed Draw Term Lender be evidenced by a single promissory note payable to the order of such Delayed Draw Term Lender substantially in the form of Exhibit A-2 as amended restated supplemented or otherwise.

With a DDTL you can withdraw funds several times from a predetermined loan amount. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closedDraw term loans are structured with a maximum loan amount that can be accessed throughout a certain time frame called a draw period. Business concept meaning delayed draw term loan with phrase on the sheet.

Business concept meaning delayed draw term loan with phrase on the sheet. The ticking fee is due until. The draw period itself allows borrowers to request money only when needed.

For example the involved parties can agree upon intervals such as every three six or nine months. - download this royalty free Stock Photo in seconds. Upon issuance the issuer recognizes a liability equal to the.

The Delayed Draw Term Loan may consist of Base Rate Loans or LIBOR Loans as further provided herein. CITIBANK NA as Lender. The primary purpose for DDTLs is to fund additional.

Upon issuance the issuer recognizes a liability equal to the proceeds eg cash received less any allocation of proceeds to other instruments issued with the debt or. Delayed draw term loan term sheet. Delayed Draw Term Loan Notes.

A 150000000 senior secured delayed draw term loan B the Delayed Draw Term Loan will be advanced in one drawing on the date on which the Acquisition as. Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions. A draw period is the amount of time you have to withdraw funds.

Term debt has a specified term and coupon. EX-101 4 dex101htm CITI DELAYED DRAW TERM AGREEMENT Exhibit 101. The full value of the loan is used up.

The loan is terminated by the borrower. The coupon may be fixed or based on a variable interest rate. Subject to the terms and conditions set forth herein the Lender agrees to make a term loan a Delayed Draw Term Loan to the Borrower in Dollars in up to four 4 Delayed Draw Term Loan Borrowings each on any Business Day during the Delayed Draw Term Loan Availability Period and.

However they can also be attached to unitranche financing. What Is A Delayed Draw Term Loan Ddtl Advanced Lbo Modeling Test 4 Hour Example Excel Template 2 2 2. More stock photos from this artist See All.

As private credit providers flock back to the business of d elayed-draw term loan lending in the wake of the COVID-19 pandemic borrowers may find more restrictive rules governing their use. Each Borrowing of Delayed - Draw Term Loans shall be in a principal amount of 2000000 or a whole multiple of. And CITIGROUP GLOBAL MARKETS INC as Lead Arranger and Bookrunner.

The withdrawal periods are also determined in advance. Photo about Business concept meaning Delayed Draw Term Loan with phrase on the sheet. Answer Easy Questions Create In Minutes - Save To PDF Word - Jumpstart Your Business.

Unlike a traditional term loan that is provided in a lump sum a DDTL is released at predetermined intervals. Image Editor Save Comp.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Corporate Banking Sell Side Handbook

Family Loan Agreements Lending Money To Family Friends

Advanced Lbo Test Modeling Test Private Equity Interview Training Excel Template

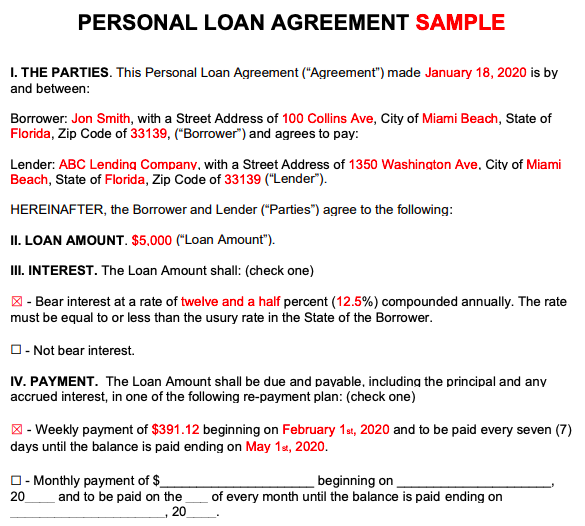

Personal Loan Agreements How To Create This Borrowing Contract

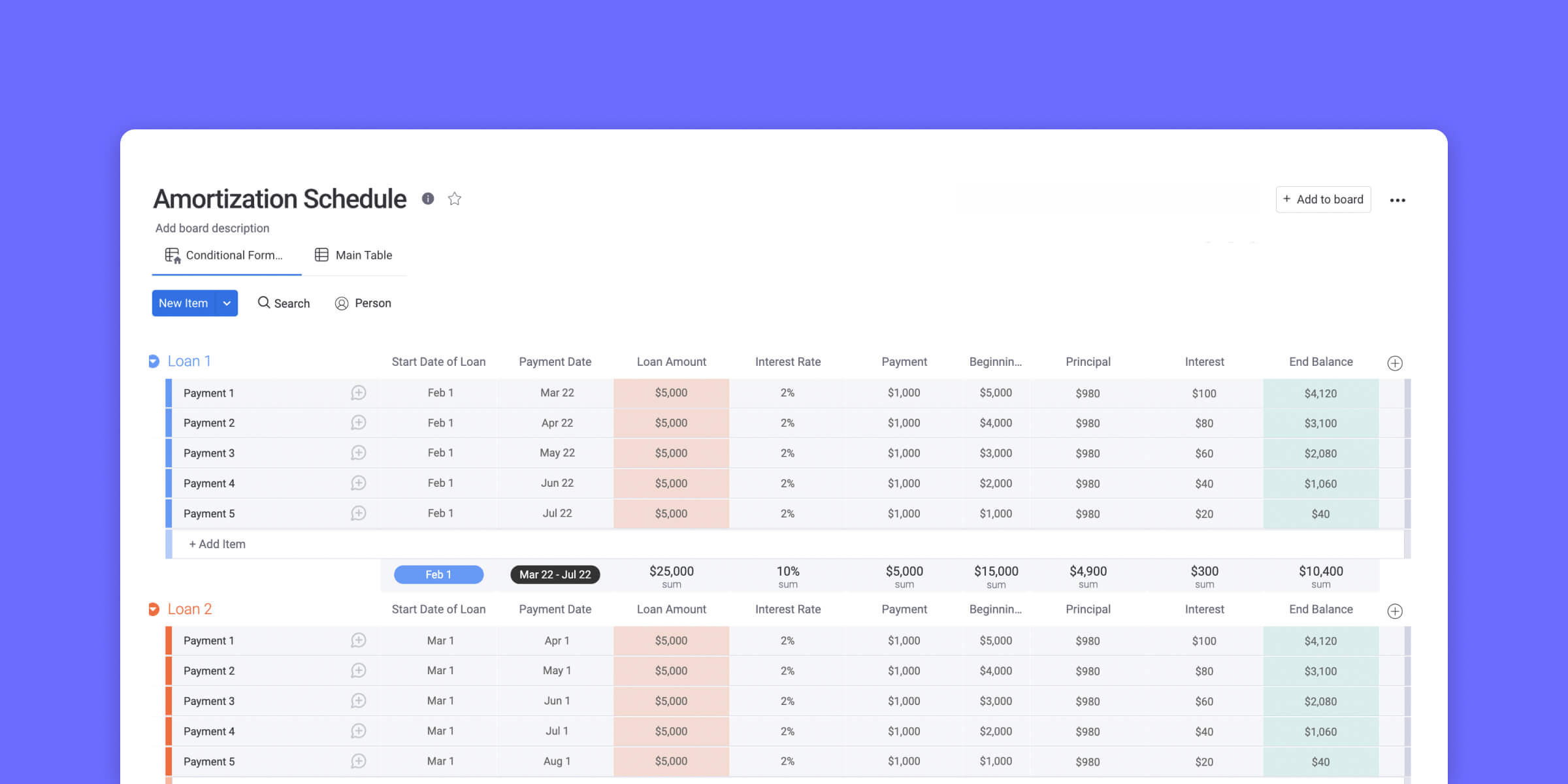

Easy To Use Amortization Schedule Excel Template Monday Com Blog

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Free Loan Agreement Template Pdf Templates Jotform

Advanced Lbo Test Modeling Test Private Equity Interview Training Excel Template

When Is Venture Debt Right For Your Business Silicon Valley Bank

Capital Markets Group Houlihan Lokey

When Is Venture Debt Right For Your Business Silicon Valley Bank

What Are Loan Terms Forbes Advisor